Selling My House… Should we have an Open House?

Are Open Houses worth the time and effort when selling your house? It really depends because the effectiveness of open houses in selling a home can vary depending on various factors, location and who is hosting them, so opinions on their effectiveness are mixed among real estate professionals. Here are a few things to consider:

- Exposure: Open houses provide an opportunity for potential buyers to physically tour a property without scheduling a private showing. This can increase the exposure of your home to a broader audience.

- First Impressions: Open houses allow buyers to experience the home in person and form a first impression. A well-staged and well-maintained home during an open house can leave a positive impact on potential buyers.

- Competition: In a competitive real estate market, open houses can create a sense of urgency among buyers. If multiple interested parties visit the open house, it may lead to competitive offers.

- Networking: Real estate agents often use open houses as a networking opportunity. They may meet potential buyers who are not working with another agent or gather feedback that can be valuable in adjusting the marketing strategy.

On the other hand, some argue that open houses may not be as effective as other marketing strategies for selling a home. Here are some reasons:

- Serious Buyers: Some critics argue that the majority of people attending open houses may not be serious buyers but are instead neighbors or individuals simply curious about the property.

- Digital Marketing: With the prevalence of online listings, high-quality photos, virtual tours, and 3D walkthroughs, buyers can preview a property from the comfort of their homes. This can reduce the necessity of physical open houses.

- Privacy Concerns: Sellers may have concerns about the security and privacy of their homes during open houses, as strangers are allowed to walk through the property.

Ultimately, the effectiveness of open houses can vary based on the local market conditions, the specific property, and the overall marketing strategy employed by the real estate agent. Sellers should discuss the potential benefits and drawbacks of open houses with their real estate agent to determine if they are a suitable part of their overall sales strategy.

Sold Your House in 2023? How to Prep for Taxes.

I am not a tax professional, but I can offer some general guidance to help you prepare for taxes after selling your home in Virginia. For accurate and personalized advice, it’s recommended to consult with a tax professional. Here are some steps you may want to consider:

- Gather Relevant Documents:

- Collect documents related to the sale, such as the settlement statement (HUD-1), sales contract, and any receipts for home improvements.

- Determine Capital Gains:

- Understand the capital gains on the sale of your home. Generally, you can exclude up to $250,000 of capital gains ($500,000 for married couples filing jointly) if you meet certain criteria, such as having lived in the home as your primary residence for at least two out of the last five years.

- Report the Sale on Your Tax Return:

- File the sale of your home on your federal income tax return. You may need to use IRS Form 1040 and potentially additional forms, such as Schedule D.

- State Tax Considerations:

- Be aware of any state tax implications. Virginia does not have a separate state capital gains tax, but other state taxes may apply.

- Document Home Improvements:

- Keep records of any home improvements you made, as these costs can be added to your home’s cost basis, potentially reducing your capital gains.

- Understand Exemptions and Credits:

- Be aware of any exemptions or credits you may be eligible for. For example, first-time homebuyers may qualify for certain credits.

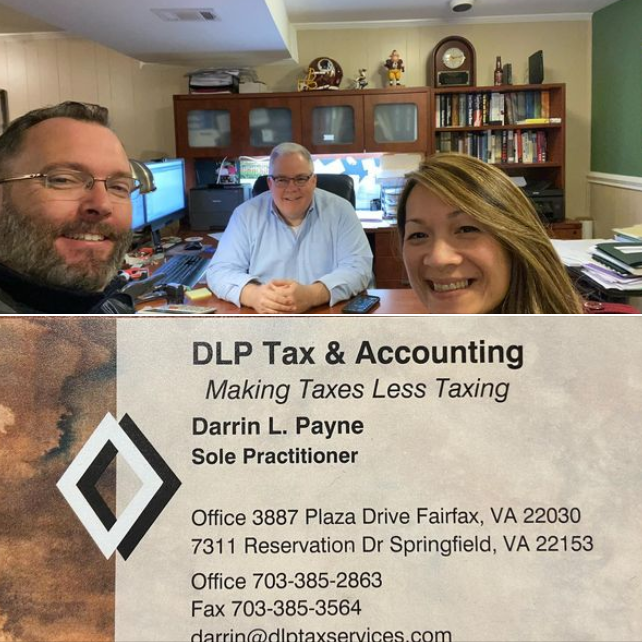

- Consider Professional Advice:

- Consult with a tax professional to ensure you understand all tax implications specific to your situation. They can provide personalized advice based on your financial circumstances.

- Check for Changes in Tax Laws:

- Tax laws can change, so be aware of any updates that may affect your tax situation. Tax professionals stay informed about these changes.

Remember that tax situations can vary based on individual circumstances, and tax laws may change. It’s crucial to consult with a tax professional to ensure you’re meeting all necessary requirements and taking advantage of any available deductions or credits.

Is There a Magic Pill to Sell Your House Quickly?

While there isn’t a single “magic” action that guarantees a successful home sale, one crucial aspect is pricing the property right. Proper pricing can significantly impact how quickly a home sells and the final sale price. Here’s why it’s so important:

- Attracts Potential Buyers:

- Correct pricing ensures that your property falls within the budget range of potential buyers. This broadens the pool of interested individuals.

- Competitive Advantage:

- Properly priced homes are more competitive in the market. Buyers often compare multiple listings, and a well-priced property stands out.

- Reduces Time on Market:

- Overpriced homes tend to linger on the market, becoming stale and potentially raising suspicions among buyers. A well-priced home is more likely to sell within a reasonable timeframe.

- Maximizes Perceived Value:

- Buyers often have a clear idea of the value they expect for a home. If the price matches or slightly exceeds their expectations, it creates a positive perception of value.

- Minimizes Negotiation Challenges:

- Overpriced homes may experience more extended negotiation processes, and sellers may be forced to make larger price reductions. A properly priced home sets the stage for smoother negotiations.

- Enhances Marketing Effectiveness:

- A well-priced home aligns with the marketing efforts and attracts the right audience. It is more likely to be featured prominently in online listings and attract serious inquiries.

To determine the right price for your property, consider the following:

- Comparative Market Analysis (CMA):

- Conduct a thorough analysis of recent sales, current listings, and expired listings of similar properties in your area.

- Consult with Real Estate Professionals:

- Seek advice from local real estate agents who have a deep understanding of the market. They can provide insights into pricing strategies based on current market conditions.

- Consider Market Trends:

- Be aware of the overall real estate market trends in your area. Factors such as supply and demand, economic conditions, and interest rates can influence pricing.

- Be Realistic:

- While every seller hopes to get the highest possible price for their home, it’s important to be realistic about the property’s value based on market conditions and comparable sales.

Properly pricing your home from the beginning increases the likelihood of attracting the right buyers and ultimately results in a successful and timely sale.

What You Should Expect During the Home Selling Process

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link